TRADERS CORNER

98% of Retail traders fail because they give up too easily on a system/indicator. They jump from strategy to strategy, indicator to indicator. Is that you? Or when you lose, you look for another indicator to prevent the loss? In order to be successful consistently, you have to develop a strategy like they do in the institutional world. How?

- Use one indicator/strategy and apply it one time frame and one instrument class.

- Collect data i.e. snapshot of the chart setup, snapshot of the chart results, statistics for each trade, etc.

- Compile the data in a powerpoint slide. First slide should the be trading plan. Second slide should be a table summarizing the results i.e winning trades, losing trades, cancel trades, win/loss ratio, reward risk, etc.

- Add a rule with indicator/concept to see if you can eliminate the losing trades and keep the big winning trades. If rule/concept does not improve win/loss ratio, throw it away and try another. If it does, that is your new trading plan and repeat #4 until fully optimized for win/loss ratio.

- Once win/loss ratio optimized, examine the winning and losing trades and see if you can create a new rule/concept to improve reward/risk with preserve mode or targets.

_________________________________________________________________________________________

Sector Analysis December 8, 2018

Technology vs SPY

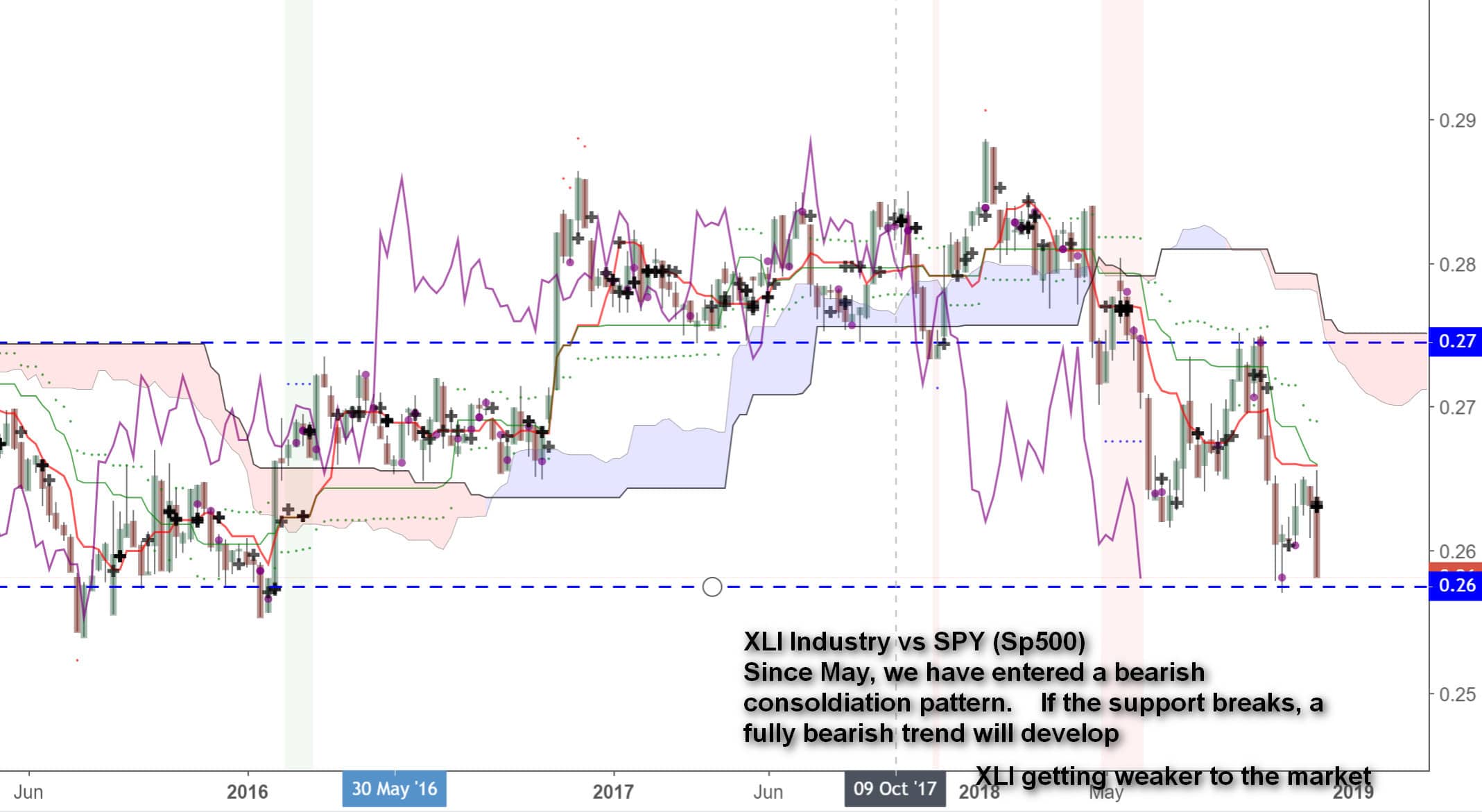

Industrial vs SPY

Financial vs SPY

Material vs SPY

Telecomm vs SPY

Healthcare vs SPY

Utilities vs SPY

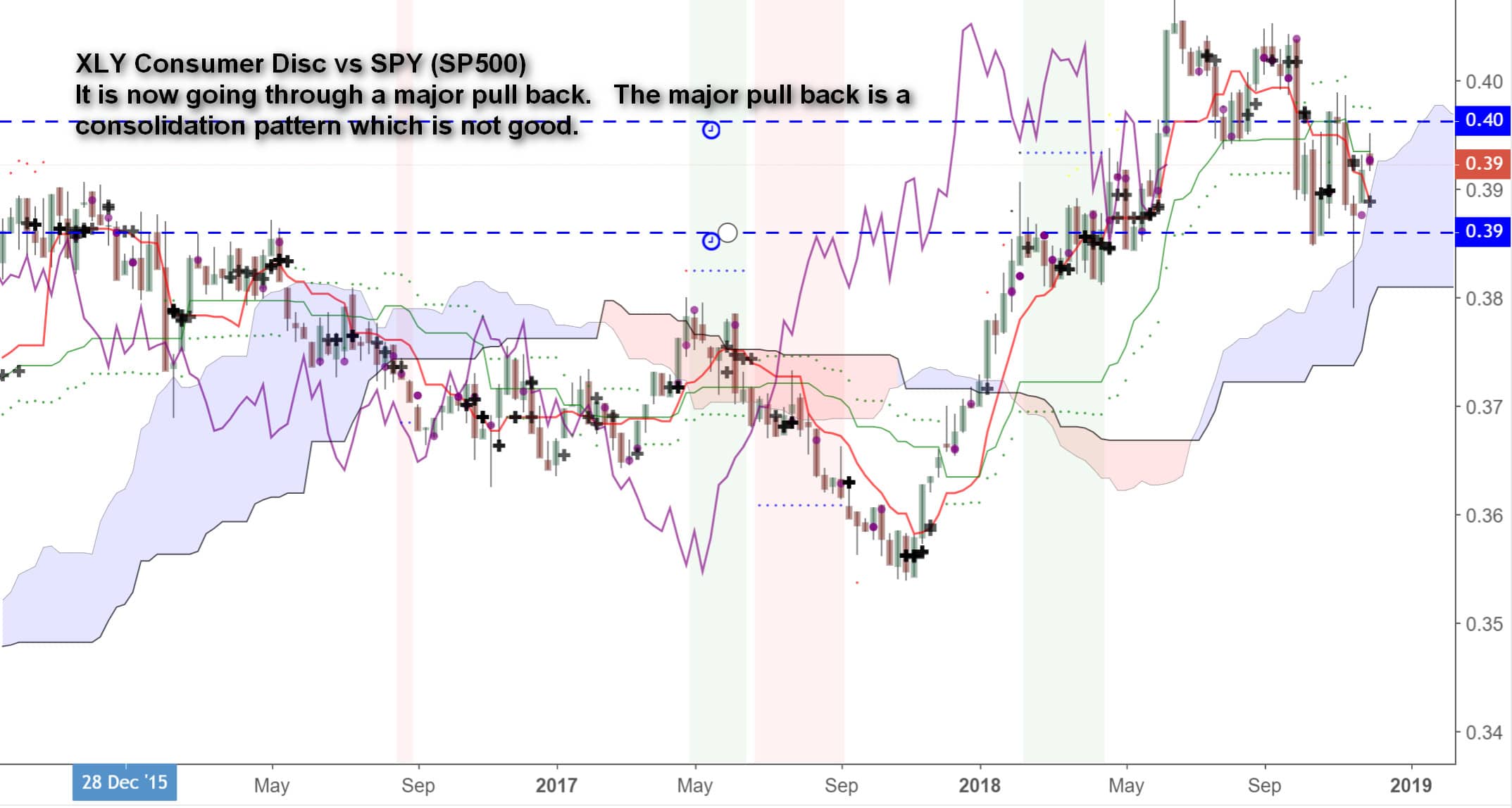

Consumer Disc. vs SPY

Consumer Staples. vs SPY

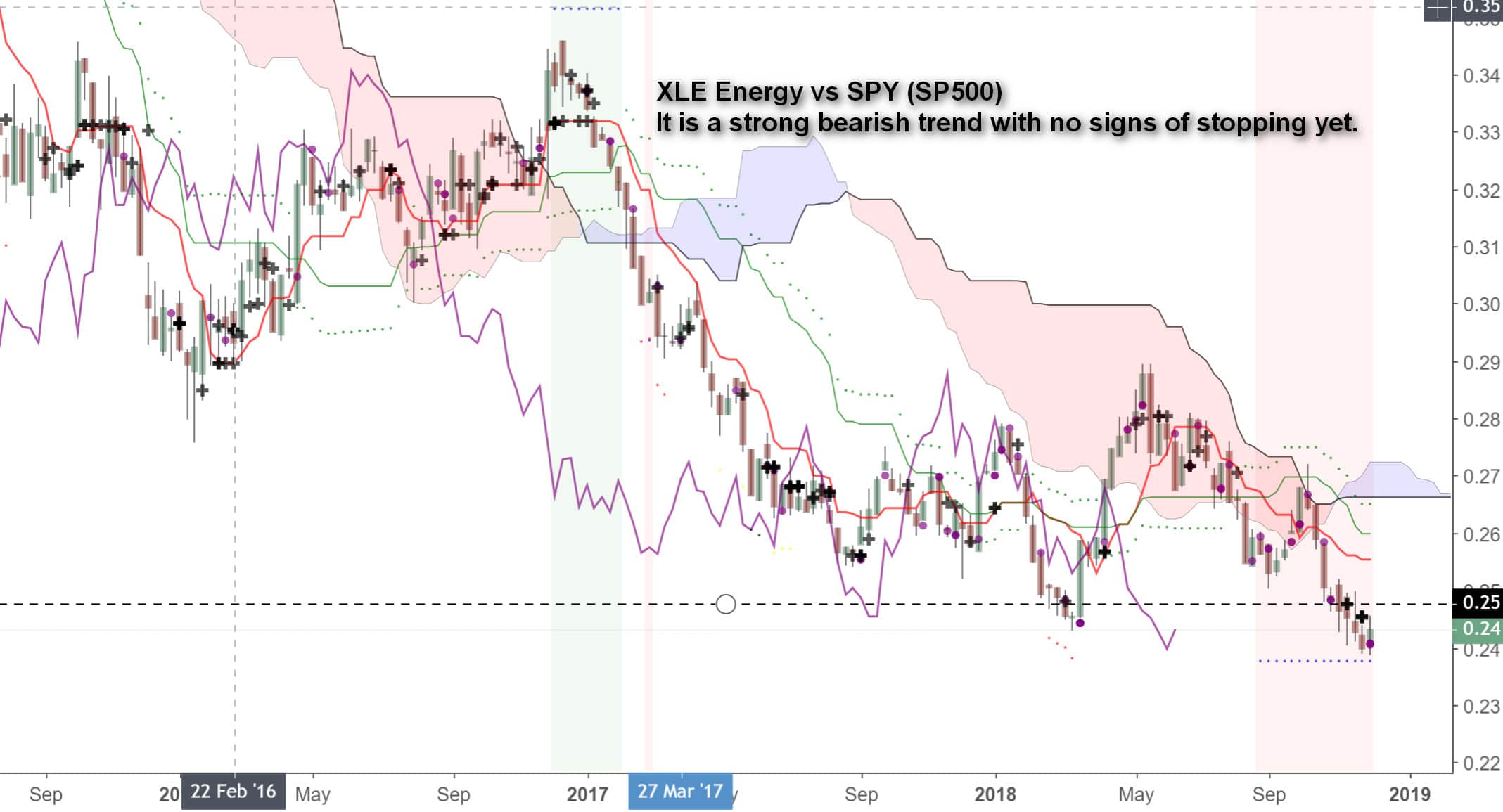

Energy. vs SPY

If you would like to learn how to trade like an institutional trader or learn more about our AI based multiple time frame support/resistances, go to www.imtftrade.com or email us at info@eiicapital.com

EDUCATIONAL USE.

Risk Disclosure: https://imtftrade.com/disclaimer