I have been in the CADJPY for awhile now. A lot of people are asking if they should get in and where? Usually, it is not good to get into a trend when it has been occuring for awhile. If you do, you need to play it very cautioniously until you have a “free trade” i.e. where you Stop is above your entry value.

As an analyst, you observe the past behavior in order to determine future price/time movements. When an instrument is at it’s all time high, you can not determine support/resistance values from the past. As a result, it is hard to determine where you should take profits or where to get into a exisiting trend trade.

For the CADJPY currency pair, we have no resistance value since it is at it’s all time high. Therefore, we are going to use Fib. values in order to “watch” our trade as it progresses up through various Fib. values.

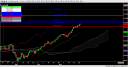

If you look at the chart, Ichimoku tells us that the pair is still in a healthy bullish trend due to the Kijun Sen on the daily time frame. Therefore, if you have not entered the trade, we can set an entry level based on a break of a Fib. value or last resistance value. Once we are in the trade, we will be using Ichimoku to manage the trade. However, we will be watching price move upwards through the various Fib values until we have a free trade. At that point, we will not use anymore Fib values.

Lets look at this currency pair in Harmonic Analyzer to determine Fib values. Here is the chart. Notice that today’s high was the Fib value of 3.618 extension. Therefore, tomorrow could be a possible turning point. If price breaks through today’s high then chances are very high that we will move to the next Fib value. The next important Fib value is at 117.389. There are smaller fib values which we will draw but this is the big one.

Below is our analysis on the CADJPY currency. We have drawn the small Fib values along with the important value. Also, we have drawn the entry value at 3.618. Price was a little below 3.618 so we are fine in using this value instead of using today’s high with a buffer. Also, we really can’t use the daily Kijun Sen as a Stop since it is at 109.69. It is far away since the bullish trend has been occuring for awhile. The daily Kijun Sen is almost 500 pip away from the current price.

Since we are entering the trade late, we are going to use the Kijun Sen from the 8 hour as our stop. This is drawn already on the chart.

For EDUCATIONAL USE. Commodity Futures Trading Commission, Forex, Futures, Equity and options trading has large potential rewards, but also large potential risk and may not be suitable for everyone. You must be aware of the risks and be willing to accept them in order to invest in these markets. Do not trade with money you can not afford to lose. This is neither a solicitation nor an offer to Buy/Sell. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this document. The past performance of any trading system or methodology is not necessarily indicative of future results. All information provide d on the Blog is for educational purpose .