Last week was a very interesting week especially Friday. We had two distribution days for the SPX/SPY which really has not occurred for a long time. If you look at the trend, we have had a total of 7 down days with some minor pull backs.

Our seasoanal (not predictive of future results) chart shows us that we are in a bearish mode until 6/30 which is this Sat. Remember, it is always +-3 days. This would put us around Wed/Thursday being a possible reverse date. This is very interesting because the Fed is having there big meeting this Thursday which will definitely move the markets.

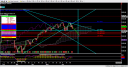

Let’s analyze the SPX on our charts. The light blue lines represent Gann lines. The Red lines represent the Support values and the dark blue line represents the resistance line. What was interesting in drawing the Gann lines is that a possible reversal date was also 6/30 which matched our seasonal charts. Based on the Gann lines and the support lines, I have drawn the possible SPX price target where a reversal could take place. This value was 1472.81. Even though, I am showing a bearish price target, price could move up to test the Gann lines again at 1535. Our Ichimoku system is telling us we are in a consolidation mode.

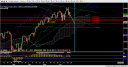

Let’s look at the S&P mini-futures to see if it tells us anything. Using the same concepts as the SPX. The price target will be 149150 by the end of this week with a possible reversal date anytime after Wednesday.

Let’s look at the VIX. Below is the VIX, notice how it bounce right off the top of the Kumo cloud at 16.23. 16.23 is a major resistance value for the VIX. Friday’s pull back was right at the .886 Fib value and it then bounced down lower. However, the VIX is consolidating.

All our charts tell us that 6/30 is a possible reverse date (+-3 days). The overall sentiment is still bullish but we are in a consolidating mode. Since we are long term position traders, we are not going to trade at this time. We will keep on watching the charts until they tell us that a trade exists.

For EDUCATIONAL USE. Commodity Futures Trading Commission, Forex, Futures, Equity and options trading has large potential rewards, but also large potential risk and may not be suitable for everyone. You must be aware of the risks and be willing to accept them in order to invest in these markets. Do not trade with money you can not afford to lose. This is neither a solicitation nor an offer to Buy/Sell. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this document. The past performance of any trading system or methodology is not necessarily indicative of future results. All information provide d on the Blog is for educational purpose .