Our blog on the VIX was “spot on the dot”. Our bullish positions are doing really good. I expected the big move to occur tomorrow (Thursday). The FOMC announcement is tomorrow. Also, seasonal patterns show that the Thursday before the end of June is typically a very bullish day. Today’s big move up is very concerning. What caused this huge move? What caused the VIX to move 17% in one day?

Let’s look at the charts. We start by looking at the SPX chart. Price closed right at our Gann line (blue). Our Ichimoku indicators still indicate a bearish sentiment but it is very weak now. Soo weak, it can change in one day. If we close positive tomorrow then a bullish trend may develope for a couple of days.

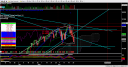

Let’s look at the S&P mini-futures. This chart was very interesting. The futures and the SPX cash index deviated a lot today. The futures took off and closed very high were as the SPX cash index closed higher but not the same percentage as the futures. This is very concerning. A deviation between the future and the cash index should not be this big. If you look at the chart, you will notice that it broke through the main Gann line. The same Gann line that the SPX has not broken yet.

Let’s look at the Fib values in Harmonic Analyzer. Below is the SPX in HA. In looking at the charts, notice we need not reverse off a Fib value. That is concerning because we typically reverse off a Fib value.

Let’s look at the Fib values in Harmonic Analyzer for the S&P mini-futures to see if it reversed off Fib values or not. Just like the SPX, it did not reverse off the Fib values.

In conclusion, what does all this mean? I am going to stay in my bullish trade but have a tight stop. It is very concerning that the charts did not reverse off Fib values.

For EDUCATIONAL USE. Commodity Futures Trading Commission, Forex, Futures, Equity and options trading has large potential rewards, but also large potential risk and may not be suitable for everyone. You must be aware of the risks and be willing to accept them in order to invest in these markets. Do not trade with money you can not afford to lose. This is neither a solicitation nor an offer to Buy/Sell. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this document. The past performance of any trading system or methodology is not necessarily indicative of future results. All information provide d on the Blog is for educational purpose .