Right now, the SPX is in a major consolidation mode. We are going to stay on the side and wait for a trend. It probably won’t happen until the Fed’s meeting next week.

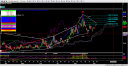

Here is the technical analysis below. Ichimoku shows that we are in a consolidation mode from a bullish sentiment. The SPX has to close 1437 for a possible trend change to occur (bearish). On the chart, you can see the Gann angles along with the Ichimoku indicators.

Below is t

he VIX analysis. Yesterday, it traced close to the .5 value but did not get there. All the signs on the chart show some bullish sentiment still. It seems like the VIX wants to try to get to the .618 retracement value. With all the volatility in the market, it could happen within 2 weeks.

The seasonal chart shows a bullish/consolidation mode until around 9/19. At that point, the market is suppose to move down drastically.

For EDUCATIONAL USE. Commodity Futures Trading Commission, Forex, Futures, Equity and options trading has large potential rewards, but also large potential risk and may not be suitable for everyone. You must be aware of the risks and be willing to accept them in order to invest in these markets. Do not trade with money you can not afford to lose. This is neither a solicitation nor an offer to Buy/Sell. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this document. The past performance of any trading system or methodology is not necessarily indicative of future results. All information provide d on the Blog is for educational purpose .