Since price bounced off the Gann line illustrated from 6/12/07 blog, our bullish trend is still intact. However, the bullish trend is very weak so it could change very fast. The DJX, SPX, and NASDAQ moved up quickly. However, the Russell did not move up drastically as the other instruments. We will have to analyze why……..

Two pieces of data that everyone has been waiting for are going to be released this week. They are the CPI data on Thursday and the PPI is on Friday. Based on this data, the market is going to move since these are inflation related data. They will effect the bond market along with the equity market.

Right now, the 10 year Treasury notes are sitting right off a 5 year high of 5.25%. If the treasury notes go above this value then it cause further damage to the bond market. Furthermore, interest rates above 6% historically tend to stop a bull market for the equity market. Investors will prefer to invest in bonds rather then the stock market with a weak GNP growth, depressed housing market, etc.

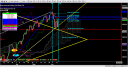

Now for the technical analysis. Below is the chart. Today’s retracement was .532 which is above .5. Therefore, we should min. reach the .682 Fib value at 1521. Analyzing the open interests on the SPX options, the best price for the SPX to open with on Friday morning would be 1525. This where the market makers will make the most money. The second strike price would be 1500. With the Fib value breaking the .5 retracement, I would guess the market is going to 1525 in the SPX by Friday morning.

puts strike calls total

| 22704 | 1480 | 44688 | 4069713 |

For EDUCATIONAL USE. Commodity Futures Trading Commission, Forex, Futures, Equity and options trading has large potential rewards, but also large potential risk and may not be suitable for everyone. You must be aware of the risks and be willing to accept them in order to invest in these markets. Do not trade with money you can not afford to lose. This is neither a solicitation nor an offer to Buy/Sell. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this document. The past performance of any trading system or methodology is not necessarily indicative of future results. All information provide d on the Blog is for educational purpose .