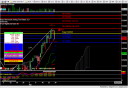

Today, the S&P mini Futures went down due to the financial market. American Express led the way. Everyone kept on saying that a correction was around the corner. As a result, the first sign of some bad news, this market went down without any hestitation. However, notice the volume on the chart. It was the same as Friday which is not too high. A lot of people have held their positions. We now have two days of bearish movement. If tomorrow closes as a bearish day then most likely our bullish trend is now in a correction mode. Remember, Gann mentioned that it takes three same days for a trend to develope. Even with the bearish move today, we came within 3 pts of 1500. Only 3pts! Do you think this market wants the 1500? I think so.

Here is the chart:

Here is the Vix chart for 2006. Notice that the Monday after the weekend, the VIX went up drastically. The VIX then went down until 5/5. After that point, it starts to move upward.

Here is the VIX chart today. As usually, price “respected” the Kijun Sen and bounced back towards it. This time overshooting it. The Tenkan Sen is pointing upwards too. If we have a bearish day tomorrow, the Kijun Sen/Tenkan will cross.

For EDUCATIONAL USE. Commodity Futures Trading Commission, Forex, Futures, Equity and options trading has large potential rewards, but also large potential risk and may not be suitable for everyone. You must be aware of the risks and be willing to accept them in order to invest in these markets. Do not trade with money you can not afford to lose. This is neither a solicitation nor an offer to Buy/Sell. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this document. The past performance of any trading system or methodology is not necessarily indicative of future results. All information provide d on the Blog is for educational purpose .