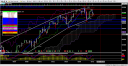

It seems like the bullish momentum is finally slowing down. Look at the 5/35 Osc in the chart below. Also, the bearish crossover between the Kijun Sen/Tenkan Sen has occurred giving us our first bearish indication. We need the Chikou Span to go bearish so it will tell us to now look for a bearish entry trade. The Chikou Span may go bearish in 1 or 2 more days.

The seasonal chart shows that a typically a bearish month until 5/26. Our price action this year is a little lagging behind the seasoanal trend but it still has been following very closely to the pattern.

For EDUCATIONAL USE. Commodity Futures Trading Commission, Forex, Futures, Equity and options trading has large potential rewards, but also large potential risk and may not be suitable for everyone. You must be aware of the risks and be willing to accept them in order to invest in these markets. Do not trade with money you can not afford to lose. This is neither a solicitation nor an offer to Buy/Sell. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this document. The past performance of any trading system or methodology is not necessarily indicative of future results. All information provide d on the Blog is for educational purpose .