$Volatility: Friend or Enemy? It is a friend that can give you a great opportunity. Today, is when the US Federal Reserve Meeting will take place with a possible interest rate cut. People have been talking about this possible rate cut for weeks. If they do, it will be the first one in a decade. With all the news in the last couple of weeks, you know volatility is going to exist.

Most people tell you to stop trading until the announcement is made. Lot of people went into cash positions too. Why? Most people fear volatility. Everyone has been taught that volatility is bad and to fear it. It can wipe out profits and cause big losses. This is correct to a certain extent. If you are on the wrong side and you do not use money management, it can cause major problems. However, if used correctly, it can give a very good reward/risk.

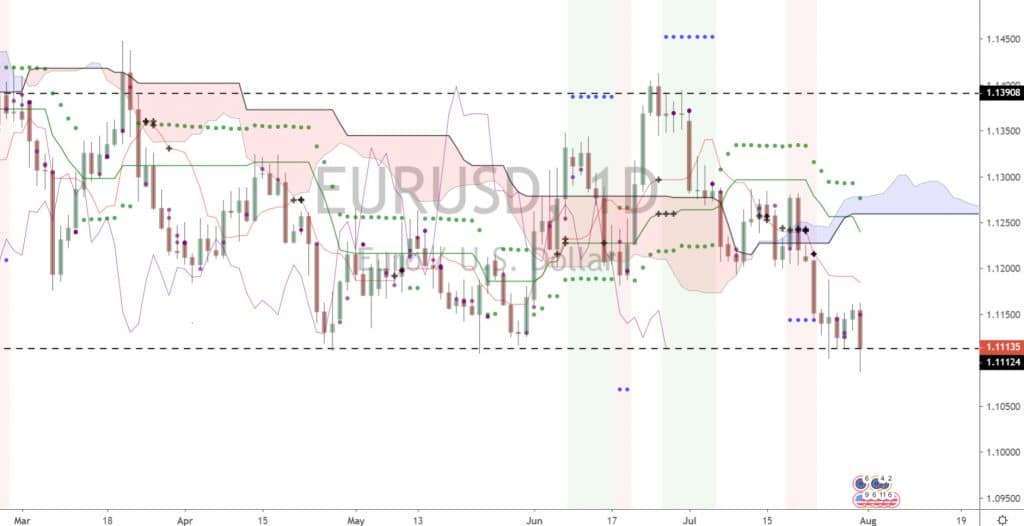

Let’s look at the EURUSD today, an example. The interest rate decision has a high probability to cause volatility to the USD dollar. As a result, we are going to look at the EURUSD because it is at major support. Below is the daily chart of the EURUSD. You can see from the chart, the instrument has been in a consolidation pattern for awhile. Before the decision, price is right on the major support i.e. the bottom of the consolidation pattern.

We are at a critical support with volatility. In order to take advantage of it, you have to use a system designed to handle volatility. If you do not, you are gambling and have potential for huge losses. For us, we are going to use Heiken-Ashi (www.heiken-ashi.com). It is designed solely for volatility.

Below is the Heiken-Ashi.com chart for the 60m time frame.

At 2am EST, price retested the high at 1.1160 and it held. It confirmed the bearish chart setup from the daily and it hours away from the Fed Announcement. Based on the trading plan, we waiting for a strong HA candle. We got it early this morning at 5am and entered at 6am EST at price of 1.1146 with a HA stop of 1.1151. This is based on our trading plan.

With volatility, we are looking for high reward/risk. The target was 1.1101 giving a 747% reward/risk. The chart setup is shown below:

The trade still existed during the announcement. During the announcement, price got the target that was plan.

If you would like to learn how to trade like an institutional trader or learn more about our multi-timeframe email alerts, go to www.imtftrade.com or email us at info@eiicapital.com

EDUCATIONAL USE.

Risk Disclosure: https://www.ichimokutrade.com/c/disclaimer/

Disclaimer. The www.imtftrade.com Web site contains or may contain references and links to other companies and/or their Web sites. The www.imtftrade.com Web site makes no representations, warranties or endorsements whatever about any other Web sites to which you may have access through The www.imtftrade.com Web site , or any products or services of those other companies, even if the products or services of those other companies or their Web sites are described or offered on The www.imtftrade.com Web site or integrated with The www.imtftrade.com Web site products or services. You use this site and all E.I.I. Capital Group (and affiliated) products and services at your own risk. In no event shall E.I.I. Capital Group be liable for any special, incidental, indirect or consequential damages of any kind, or any financial losses or damages whatever, including, without limitation, those resulting from loss of (or errors in) service, software or data, whether or not we have been advised of the possibility of such damages, and regardless of the theory of liability. This site could, and likely does, include some technical and other inaccuracies and errors.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options futures or forex); therefore, you should not invest or risk money that you cannot afford to lose.

U.S. Government Required Disclaimer – Commodity Futures Trading Commission. Futures and options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with money you can’t afford to lose. This website is neither a solicitation nor an offer to Buy/Sell futures or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this website. The past performance of any trading system or methodology is not necessarily indicative of future results.

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY, SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN. Testimonials appearing on this site are actually received via email submission. They are individual experiences, reflecting real life experiences of those who have used our products and/or services in some way or other. However, they are individual results and results do vary. We do not claim that they are typical results that consumers will generally achieve. The testimonials are not necessarily representative of all of those who will use our products and/or services. The testimonials displayed are given verbatim except for correction of grammatical or typing errors. Some have been shortened, meaning; not the whole message received by the testimony writer is displayed, when it seemed lengthy or the testimony in its entirety seemed irrelevant for the general public.

Options Characteristics & Risks of Standardized Options. <a href=”http://www.optionsclearing.com/components/docs/riskstoc.pdf”>Click here to download</a>.

https://www.imtftrade.com is owned and operated by and may contain advertisements, sponsored content, paid insertions, affiliate links or other forms of monetization.

https://www.imtftrade.com abides by word of mouth marketing standards. We believe in honesty of relationship, opinion and identity. The compensation received may influence the advertising content, topics or posts made in this blog. That content, advertising space or post will be clearly identified as paid or sponsored content.

is never directly compensated to provide opinion on products, services, websites and various other topics. The views and opinions expressed on this website are purely those of the authors. If we claim or appear to be experts on a certain topic or product or service area, we will only endorse products or services that we believe, based on our expertise, are worthy of such endorsement. Any product claim, statistic, quote or other representation about a product or service should be verified with the manufacturer or provider.

This site does not contain any content which might present a conflict of interest.

makes no representations, warranties, or assurances as to the accuracy, currency or completeness of the content contain on this website or any sites linked to or from this site.

Contact

If you have any questions regarding this policy, or your dealings with our website, please contact us here: