XAU (Gold/Silver Index) looks like a good bearish trend is developing.

The seasonal pattern shows the bearish trend is suppose to last to 7/27. This is a long term trend which we like a lot.

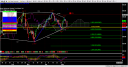

Now for the analysis. Looking at the charts, price is about to break through the Kumo cloud. The Kijun Sen/Tenkan bearish crossover has already taken place. The Chikou Span is bearish too. The Kumo cloud still does show a bearish crossover yet but that is ok for now. Basically, there will be some consolidation which the seasonals indicate too.

So how do we trade it now?

Here is the implied volatility chart to determine if we can get a long term put since we are looking for the trend to finish around 7/27. Below is the 1 year implied volatility. You can see it is at its all time low value (<20%). This is very good because it tells us that volatility needs to go up in order to get to the average volatility for equilibrium to be reached. Typically, if volatility goes up, the stock goes down. It is an inverse relationship. Also, since volatility is low, the options should be cheap.

Looking back at our charts, we are looking for the stock to go to around .886 or 1.27. If this is going to be long term trend, I would think it would go to 1.27 which is around 121. This says that we should purchase the September 120 puts. Looking at the spread, I am going to try to get it at $2.10 per contract. The volitility is around 28%. It is higher then 20% because XAU went down drastically today, thus increasing volatility. We will expect a little consolidation where we can get in at a good price.

For EDUCATIONAL USE. Commodity Futures Trading Commission, Forex, Futures, Equity and options trading has large potential rewards, but also large potential risk and may not be suitable for everyone. You must be aware of the risks and be willing to accept them in order to invest in these markets. Do not trade with money you can not afford to lose. This is neither a solicitation nor an offer to Buy/Sell. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this document. The past performance of any trading system or methodology is not necessarily indicative of future results. All information provide d on the Blog is for educational purpose .